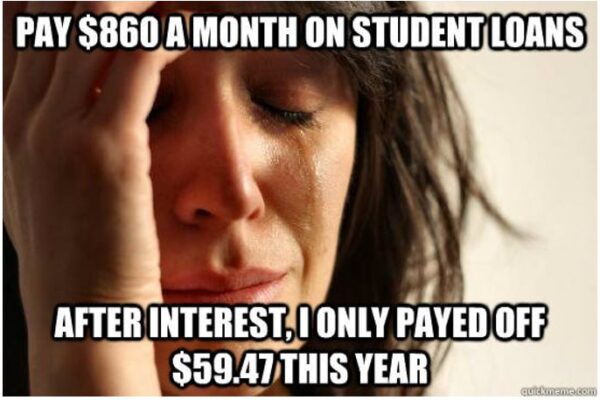

The other day I was scrolling through Facebook when I came across a meme that made me want to laugh and cry at the same time:

Writer’s note: I take full accountability for my choices. I knew I would have student loans after I graduated. I chose to go to college and I also chose one that was a private school so, yes, cue the world’s smallest violin as I speak about my student loans.

At one point in my post-grad career, I had to temporarily switch to an Income-Sensitive Repayment Plan. This option stipulated that the loan payments were going to be based on my annual income. I was only on this plan for about one year but I was paying almost $200 less than what my regular payments were supposed to be. After interest, I had only $70 going toward the principal amount – hence, my tears looking at that meme. Eventually, I got back on track to a regular repayment plan but there was still that burning question inside of me: Why are student loan interest rates so high and how can one possibly get past them?!

You would think that because higher education is seen as an incredibly valuable asset, along with recent graduates not having amassed a significant amount of wealth, student loans would be some of the lowest interest rates around, right?! In a lot of instances, that just isn’t the case. A main component of this is that student loans, like unsecured loans, are not linked to a tangible asset that can be used as collateral. Because you cannot take back someone’s degree if they don’t repay their loans, there is greater risk for a lender. As a result, rates are generally higher than when compared to a secured loan rate.

I understand this thought process, however, it doesn’t solve the issue that I face. How am I supposed to pay down my loan if I can barely get past the interest? After doing some research, I’ve found some helpful tips and tricks on how to lower the interest rate on both federal and private student loans:

Think of refinancing as a trade. When you refinance, you trade in your existing loans for a new private loan, ideally with a lower interest rate. Your new lender pays off your old lenders and you make payments to the new lender going forward. There are some qualifications:

While refinancing is your best bet, many Federal loans and private lenders offer a 0.25% interest rate discount when you sign up to have payments automatically deducted from your bank account. The best thing you can do is contact your loan servicer to find out if the discount is available! An added bonus – you won’t accidentally miss a payment!

It may sound redundant but a high credit score gives you a solid foundation to help you reach your financial goals. Particularly with private lenders, the higher your credit score, the lower the interest rate will be. Keep in mind, Federal Loans don’t require a credit check so rates won’t be affected by credit scores.

If you’re struggling to establish credit, it’s okay! Consider adding a parent or relative, who has a more established record, as a co-signer. Adding a co-signer with good credit improves your overall credit picture and may help you score a lower rate.

I think the 45 million U.S. borrowers who are in a whopping $1.7 trillion worth of debt would agree with my opinion that student loans are just the worst. And while lowering interest rates is not the end-all be-all solution to combating student loans – it does help. Be savvy with your money and do your research so that you can make informed decisions about which student loan option is right for you.

As an MVCU member, you have access to free resources that can help you with your college-related financial decisions! From early research in high school all the way through graduate loans and refinancing later down the road. Student Choice provides financial aid, grant, and loan information.

Category: College Bound

You just got home from your beach vacation. Instead of unpacking, you spend hours scrolling through photos reminiscing about your time away. But then reality sets in when you realize it is Sunday night and you have to work the next day. Your stomach grumbles but the fridge is empty because you haven't been grocery shopping for 2 weeks.

It is officially summertime, you’ve put in the request for some time off at work and you’re ready for some much needed R&R! You finally start to plan out your vacation getaway, and then… you see that the expenses are adding up quickly. The last thing you want is to arrive at your destination and realize you’re out of money. So how do you plan a vacation without overspending, that also fits your budget?!

Spring is finally upon us! While most people are thinking about spring cleaning their homes, it is equally as important to think about cleaning your finances. Yes, just like that one crinkled shirt hidden in the depths of your closet that you promise “you will wear one day” – your finances need some reevaluating, too! So, where do we even start? Here are a few tips and tricks to start spring cleaning your finances:

Before we start, I already know what you’re thinking, “Olivia, you’re not good at saving money. Is this going to be a huge flop like the ’No Spend November‘ challenge?” And my answer: potentially. I always do my best to be transparent when it comes to money… and I am a work in progress! I cannot guarantee this spending plan is going to be my “a-ha moment” where I get my life and finances together, but it is worth a shot!

Ah, February – the month where love is in the air and, for us single folk, it is the month where we get amazing deals on post-Valentine’s Day chocolates. In February, relationships are celebrated with romantic dinners and roses, however, there is an important relationship that often goes uncelebrated – your relationship with yourself!

When you’re 25 years old, retirement seems so far away. Even though I have at least 40 more years in the work force (sigh) I still know that one day I am going to be burnt out from working 5 days a week- I already am! Eventually, I’ll need to stop working as hard as I am now to enjoy some relaxation except I can’t get to that point if I run out of money prematurely.

When my mom was growing up, my grandparents would pull off the clown car illusion of stuffing every neighborhood kid into their car to go get an ice cream cone every Friday night. There were days when my grandparents had only a couple dollars in their pockets, yet, they never turned anyone down.

The painful truth for most people my age- we have no clue how to file taxes. And what do you do when you have no clue how to do something? Ask your parents!

When I was 10 years old, I envisioned that by age 23 I would be an “adult.” I’d be married and living in a colonial home that I’d raise my family in. Fast forward 16 years. At 26 years old, I am not married, I still live at home with my parents and I couldn’t imagine having kids of my own right now. It seems laughable now but how did my 10 year old vision change so drastically over the years?

Is anyone else confused at how it is already 2022?! Growing up, I always felt that the years were so much longer. However, the older I get the more I realize how quickly each day goes by. I began my career at the credit union when I was young and fresh out of college. Now, I am in my late 20’s and my back pops when I bend over!

Hi my name is Olivia and I am a total clothes horse. I buy for a mixture of reasons, including being a spin instructor so always “needing” new workout sets or severely overestimating the amount of times I go outside my house. In reality, I wear the same t-shirt and sweatpants every day (yay for working from home!). Essentially, I have spent so much on clothes that my bedroom has started to look like a TJ Maxx popup shop.

At one point in my post-grad career, I had to temporarily switch to an Income-Sensitive Repayment Plan. This option stipulated that the loan payments were going to be based on my annual income. I was only on this plan for about one year but I was paying almost $200 less than what my regular payments were supposed to be.

When I was young, I was gifted the coolest plastic safe. It was deep grey with a bright purple handle that you would spin to open and it had clinking sound effects whenever you opened the safe and deposited money. Since this was before I had a savings account, I threw all of my money in there until it would all fall out when I opened the safe.

According to a survey from CreditCards.com, “47% of Americans are carrying credit card debt.” This statistic would make my grandfather furious if he heard it. He would often say to me, “Vivi, the world started to go downhill once they introduced plastic money!” Following my grandfather’s testament to the downfall of society, he would then tell me the story of how he used to always leave a wad of cash in his work locker for emergencies.

If you’ve been a regular reader of the ThinkPink blog series, you should be well-versed on the importance of a budget. When it comes to saving money and having a plan, a budget is one of the best ways to take control of your finances and reach your financial goals. However, I’ve found that following through with a plan can be cumbersome and while there may be momentum in the beginning, eventually it fizzles out before a goal is even reached. Why is that?

For some readers, the No Spend Challenge could be done with ease and that is awesome! For me, a No Spend Challenge is difficult. It is especially hard when participating during the month of November. Let’s cue the smallest violin here, again. For starters, every store is now fully stocked with their transitional fall into winter pieces, which is arguably the best season for creating outfits.

When you graduate from college, one of the first things that you start to save toward is getting your own place. You just lived on your own for 4 years and had that taste of “freedom.” You could go about as you pleased without having to tell your parents where you were going at 11:00 pm. And if your diet consisted of late-night pizza and mozzarella sticks then so be it. College is essentially a 4-year long sleepover with your closest friends but then one day it ends and before you know it you are back in your bedroom at home.

Since starting this blog in 2020, we've covered a wide range of topics. It has been fun doing deep dives into the world of personal finance. All this big thinking, though, can cause us to gloss over basic financial principles.