former Cabot

Boston Credit Union

members. We’re

Over the past few months, we have been thoughtfully planning the system conversion between Cabot Boston Credit Union (CBCU) and Merrimack Valley Credit Union (MVCU) scheduled to take place in April 2025.

Once this process is complete, you will be able to take full advantage of all we have to offer including:

Please read this important information about your credit union account.

To ensure uninterrupted access to your accounts and maintain our high level of service, your member number will change. You will receive your new member number in a future mailing. Please use this new number when registering for our online or mobile banking platforms, setting up new automatic payments or deposits, or completing transactions at a Shared Branch location. We will continue to post transactions using your former number for sixty days following conversion, giving you time to redirect payments and direct deposits.

In April, all CBCU savings and checking accounts will be changed into one of the accounts listed below. You do not need to take any action; this will be done automatically. Please reference the Truth in Savings disclosure for account features and details.

| CBCU Account | New Account |

| Share | Membership Share |

| Draft | Basic Checking |

| Share Savings | Share Savings |

| Christmas Club | Holiday Club |

Membership Share:

Minimum $5.00 to open and earn dividends

Basic Checking:

No monthly maintenance fee or minimum balance

Share Savings:

No minimum to open or earn dividends

Holiday Club:

Minimum $5.00 to open and no minimum balance to earn dividends

Your statements will include activity performed in the prior calendar month. All statements will have a new look and include the same information about your account.

All members will receive a March statement in the mail.

The paper statement fee of $2 per mail statement will be waived for former CBCU members until October 2025. We encourage all members to enroll in eStatements.

If you have a home equity loan, your statement will no longer be included in your monthly or quarterly statements. Instead, you will receive a separate monthly home equity loan statement.

While there will be no change to your loan’s interest rate, monthly payments and terms, you will be issued a new account number.

Automatic loan payments from your savings or checking account to your loan will transfer to the new system. If you have a previously scheduled payment originating from another financial institution, you will need to update your account information with the originating entity.

To make a consumer loan payment by mail please use the following addresses:

Merrimack Valley Credit Union

P.O. Box 909

North Andover, MA 01845

For overnight payments:

Merrimack Valley Credit Union

75 Main Street

Bridgewater, MA 02324

You may also make online payments through MVCU online or mobile banking or visit your local branch.

For new loans, you can apply online, over the phone at (800) 356-0067, through online or mobile banking, or by visiting your local branch.

For new loans, take advantage of our easy-to-use application process available online. You can apply securely through our online or mobile banking platforms or visit your local branch for personalized assistance.

To make a home equity loan payment by mail, please use the following addresses:

Merrimack Valley Credit Union

P.O. Box 909

North Andover, MA 01845

For overnight payments:

Merrimack Valley Credit Union

75 Main Street

Bridgewater, MA 02324

You may also make online payments through MVCU online or mobile banking or visit your local branch.

Please notify your homeowner insurance company to update the loss mortgagee payee clause to:

Merrimack Valley Credit Union, ISAOA, ATIMA

500 Merrimack Street

Lawrence, MA 01843

You will enjoy exciting features and benefits when you register for online or mobile banking. You also may enroll in Credit Score, a free resource available on these platforms that offers you access to your FICO score and helps you set savings and budgeting goals.

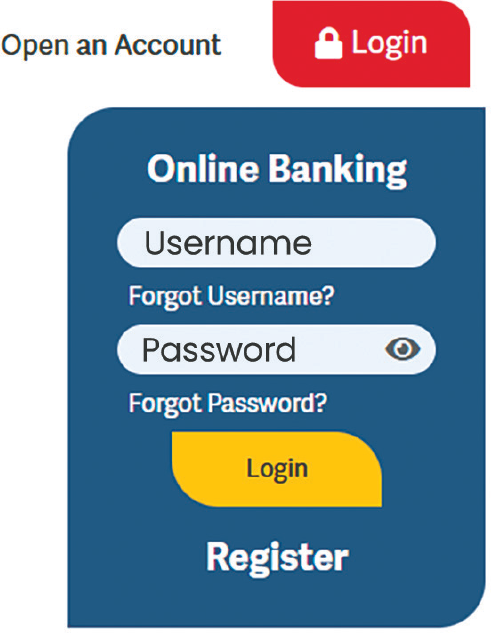

Important information about accessing your MVCU account online:

Will I be able to use the same online banking username and password that I used on the CBCU system?

Once your account has been converted to the MVCU system, you will need to register for MVCU’s online or mobile banking platforms to access your accounts (instructions for registering are found below). During the registration process, you’ll create a new username and password. If your current CBCU username and password meet MVCU’s complexity requirements, you can continue using them.

Where do I register and access MVCU’s online banking platform?

You can register and access MVCU’s online banking platform by visiting MVCU.com or by downloading our mobile app by searching “Merrimack Valley Credit Union” in the Apple and Google Play app stores.

What should I keep in mind when I register for MVCU digital banking?

*MVCU charges a monthly fee of $2 for paper statements, so be sure to enroll in eStatements to avoid the fee and help us reduce waste.

Plus, when you use our mobile app, you have access to your mobile wallet, which allows you to add your MVCU debit card to your smartphone wallet and pay with your phone, and mobile check deposit so you can deposit checks from the comfort of home.

The account disclosures are effective April 1, 2025. Please note that the Fee Schedule, effective as of February 15, 2024, remains in effect after the system conversion on April 1, 2025. No changes to fees will result from this transition.

**Skip-A-Pay: Loans must have been opened for a minimum of six (6) months prior to the first month skipped. Your account and membership status must be current and in good standing in the month prior to the month being skipped. Interest will continue to accrue on unpaid balances through skipped payment period. Account holder acknowledges that Guaranteed Asset Protection (GAP); Debt Protection/Credit Protection and/or Warranty claim benefits may be impacted due to extension of maturity date and continued interest accrual on skipped payments. Account holder assumes all responsibility for cancellation and reinstatement of third party originated payment transactions.